Stop Foreclosure in Indiana & Kentucky

Facing Forcelosure? Get Help now.

List Your Home & Protect Your Future .Get fast, reliable foreclosure help. Connect with trusted experts who help you sell before the bank takes your home.

Who We Are

Compassionate Experts You Can Count On

We’re not just real estate professionals — we’re people who believe every homeowner deserves a chance to start fresh. With years of experience in foreclosure prevention, we’ve helped families across in Indiana & Kentucky stop foreclosure, avoid credit disaster, and move forward with confidence.

Stop Foreclosure in Indiana

Our Foreclosure Prevention Services

-

Fast Property Listings – Get listed quickly before deadlines.

-

Cash Offer Options – Sell your home in days, not months.

-

Credit Protection Guidance – Minimize long-term damage.

-

Quick Closings – Avoid stressful delays.

How It Works (3-Step Process)

How We Help You Stop Foreclosure

-

Submit Your Property

Tell us about your home. -

Review Options

Explore fast listing, cash offers, or short sales. -

3. Close Quickly

Selling before foreclosure damages your future.

Why Homeowners Trust Us

Your Partner in Foreclosure Solutions

Fast Process – We help you act before the auction date.

Trusted Experts – Foreclosure specialists with proven results.

Confidential & Hassle-Free – No judgment, just solutions.

Save Your Credit – Avoid the worst financial damage.

What our client say about us

-

“I inherited a house from my Mother. I tried working with the bank but couldn’t afford the payments. My house was going to be auctioned off in a month. I called Thomas and he helped me sell it. I got enough money to pay off the bank and enough for a down payment on a smaller home. It never went to auction!.”

— Lisa M

-

“I got in over my head on a fix and flip. The hard money lender was threatening to foreclose. Thomas helped me find a buyer and they closed in two weeks. I broke even and am so thankful for that. I thought I was going to be ruined.”

— Robbie

-

“The county was going to sell my rental house because of unpaid taxes. I tried calling some “we buy ugly houses” company and they tried to rob me. Thomas got a a decent price and quickly.”

— Erich

Frequently Asked Questions About Stopping Foreclosure

Get clear answers to the most common questions about how to stop foreclosure, protect your home, and explore proven foreclosure prevention options before it’s too late.

-

You can stop foreclosure by acting quickly and choosing the right solution for your situation. Common options include loan modification, mortgage forbearance, repayment plans, short sales, or selling your home before auction. The earlier you seek foreclosure help, the more choices you may have.

-

Yes, foreclosure can often be stopped even after receiving a foreclosure notice. Depending on timing and lender rules, you may still qualify for loan modification, reinstatement, or other foreclosure prevention options. Immediate action is critical to avoid losing your home.

-

The fastest way to stop foreclosure is to contact a foreclosure specialist immediately and review all available options. In some cases, selling the property, reinstating the loan, or negotiating with the lender can delay or stop foreclosure proceedings.

-

Foreclosure prevention options may include loan modification, forbearance agreements, repayment plans, refinancing, short sales, or deed in lieu of foreclosure. Each option depends on your financial situation, loan type, and how far along the foreclosure process is.

-

Yes, selling your home before foreclosure is finalized can stop the process. If the home sells before auction, you may avoid foreclosure damage to your credit and move forward with fewer financial consequences.

-

A short sale allows you to sell your home for less than the remaining mortgage balance with lender approval. It can help you avoid foreclosure, reduce credit damage, and relieve financial stress when keeping the home is no longer possible.

-

Foreclosure can significantly impact your credit score, but stopping foreclosure early may reduce long-term damage. Options like loan modification or selling your home before auction are often less harmful than a completed foreclosure.

-

Yes, legitimate foreclosure help services exist, but homeowners should avoid scams. Be cautious of anyone demanding upfront fees or guaranteeing results. Trusted foreclosure assistance focuses on reviewing your options and guiding you through the process transparently.

-

It is rarely too late to seek foreclosure help. Even if foreclosure has started, options may still be available depending on your situation. The most important step is to take action immediately and explore all available solutions.

Foreclosure Tips & Homeowner Guides

Helpful articles answering common questions about stopping foreclosure, protecting your home, and understanding your options.

-

How to Stop Foreclosure Before Your Home Is Auctioned

Learn proven ways homeowners can stop foreclosure before auction and protect their credit and future.

-

Can Selling Your House Stop Foreclosure?

Find out if selling your home can stop foreclosure and help you avoid long-term financial damage.

-

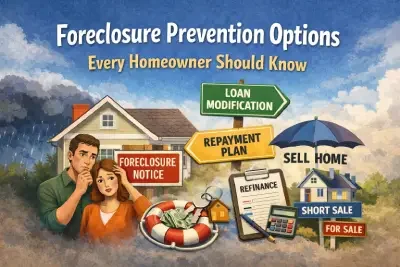

Foreclosure Prevention Options Every Homeowner Should Know

Explore the most effective foreclosure prevention options available to struggling homeowners.

Don’t Wait Until the Auction – Act Now

Explain the risks of waiting until auction (credit damage, eviction, financial loss) vs. the benefits of early action (control, better offers, less stress).